Seller financing is a term that covers a lot of different things. But it basically is a process to purchase or control a property without needing all cash of getting a loan to pay the seller off. Seller financing can be a useful tool in a tight credit market. It allows sellers to move a home faster and get a sizable return on the investment. And buyers may benefit from less stringent qualifying and down payment requirements, more flexible rates, and better loan terms on a home that otherwise might be out of reach.

In a seller financing transaction, the seller takes on the role of the lender. Instead of giving cash to the seller, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment.

Seller financing can be done in many different ways and with multiple options in the same transaction. The most common form of seller financing is with a Contract for Deed (AKA Agreement for Deed or Land Contract), but there are many alternative options available, including lease options, Subject-To and wrap around mortgages.

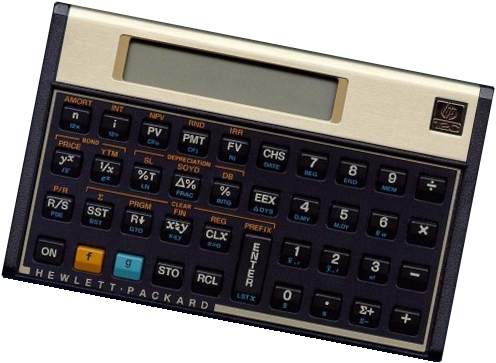

A Contract for Deed is simple to understand, you make monthly mortgage payments to the seller directly rather than getting a loan from bank or private lender. Let’s say you agree to pay the seller $100,000 and they agree to a Contract for Deed at a 6% interest rate with a 5 year balloon payment. You would pay the seller $599.55 PI (Principle & Interest) per month for 59 payments an on the 60th month (5 years) you make a lu ... Read More…

A Contract for Deed is simple to understand, you make monthly mortgage payments to the seller directly rather than getting a loan from bank or private lender. Let’s say you agree to pay the seller $100,000 and they agree to a Contract for Deed at a 6% interest rate with a 5 year balloon payment. You would pay the seller $599.55 PI (Principle & Interest) per month for 59 payments an on the 60th month (5 years) you make a lu ... Read More…