The simple answer is yes of course there is. There have always been buildups, crashes and recoveries. That is just the way things work. The real questions are when is the next big crash coming, what you do about it and how do you prepare for it.

I know people are freaking out right now, but staying informed and objective at this point will help keep your sanity.

As I am writing this, an email thread from my Lifeonaire Titanium group started circling about just this exact same topic. Some of them are taking advantage of the current market conditions because they have a great marketing machine running that is supplying them with good deals and because of the lack of inventory, they are making higher profits than they would have in a normal market. Others are starting to panic and preparing for dooms day.

Here is my quick response to them:

Everything we are seeing right now is equivalent to 2003-2005 before the big crash in 2008. While there are similarities to that time frame, there are also huge differences. As Steve stated, there are no NINJA loans right now. But they may be coming back. Lack of inventory was not the driving force back in 2003-2005. NINJA loans and other no qualifying loans were the main driving force.

My short version is this:

My short version is this:

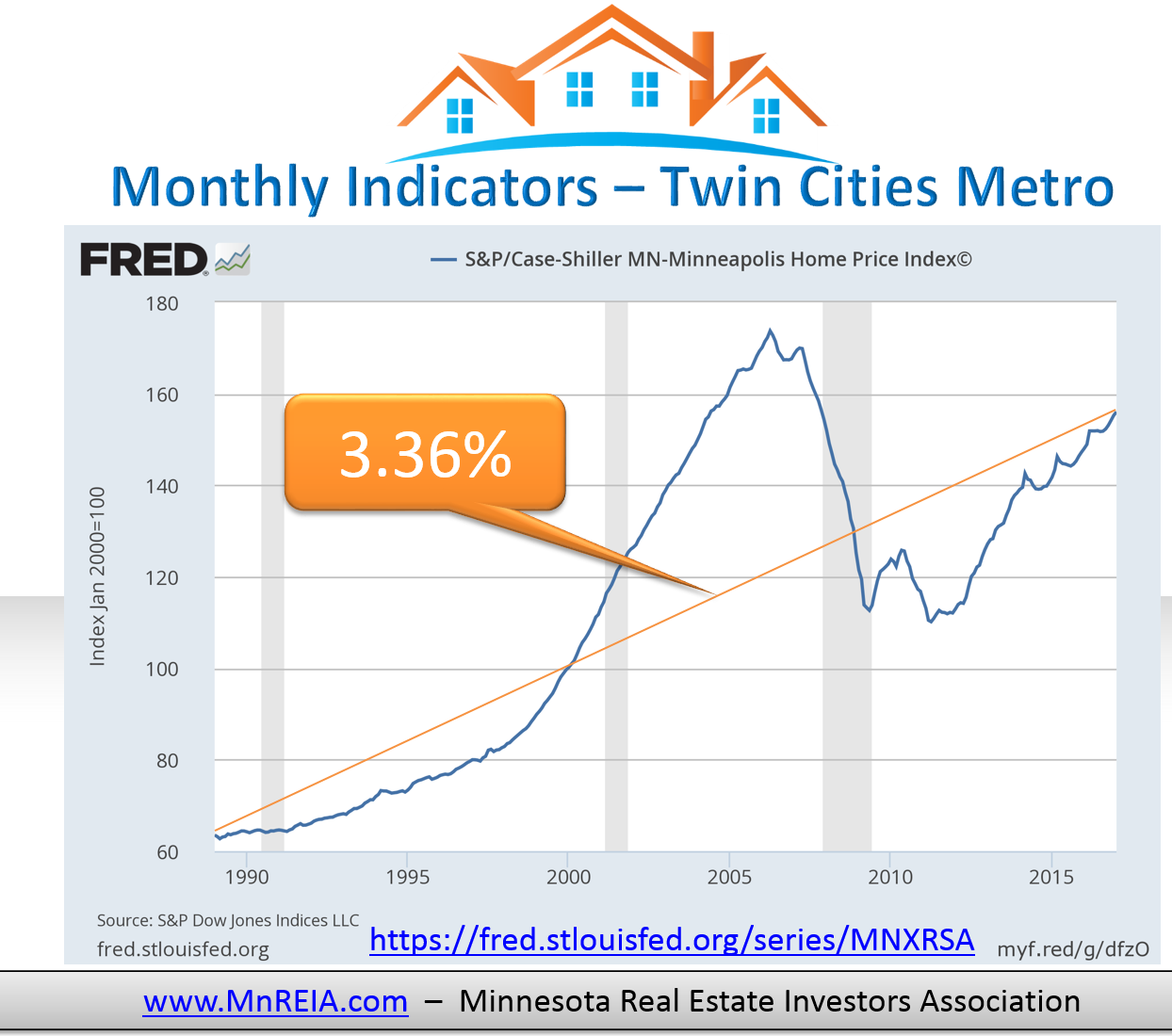

If you look at the historical price index from case shiller which is adjusted from inflation, we are not seeing the same price increases as we did the last time. Below is a screen shot of my local market that I just did for our meeting last week. As you will see, we are at a 3% appreciation over the last 27 years. Historically right were we should be. The big thing to keep an eye on right now is how the lack of inventory affects the markets.

I’m not saying everything is ok, but I am saying don’t panic, just yet.

Here is the rest of the story:

in 2002 I started asking the same questions that many people are asking now.

- How can wholesalers be asking so much for deals, the numbers don’t work?

- Where is all the inventory?

- How do you find good deals?

- Why did the buyers offer me so much more than I expected the market would bear?

Back then, those question caused me to pull back and stop buying and just maintain what I had, which at the time was more than enough to retire, if the market didn’t crash. So I didn’t buy back then because I just couldn’t believe that property values could keep going up like that, but they did for another 3-4 years. By the time I was comfortable with the new market, it was to late. Yes I did get back in, but by then the market was starting to fight back and another year later property values peaked and started softening. Opps, I should have gotten in earlier.

There were market indicators that if I was paying attention to them at the time and more importantly, could understand them, I would have been ok. There were other investors who did understand the key market indicators and were paying attention to them very carefully. I didn’t understand it back then, but I do now. First of all, most of the successful investors during the last crash, were the same ones that lost everything in the previous crash back in the late 80’s.

I plan on being them this time around. I plan on taking advantage of this market right now and when I see the key indicators start to turn, I will get out, or at least change my focus and do something different.

Key indicators:

- Interest Rates: If they go up to high, that will affect Key indicator Number 2.

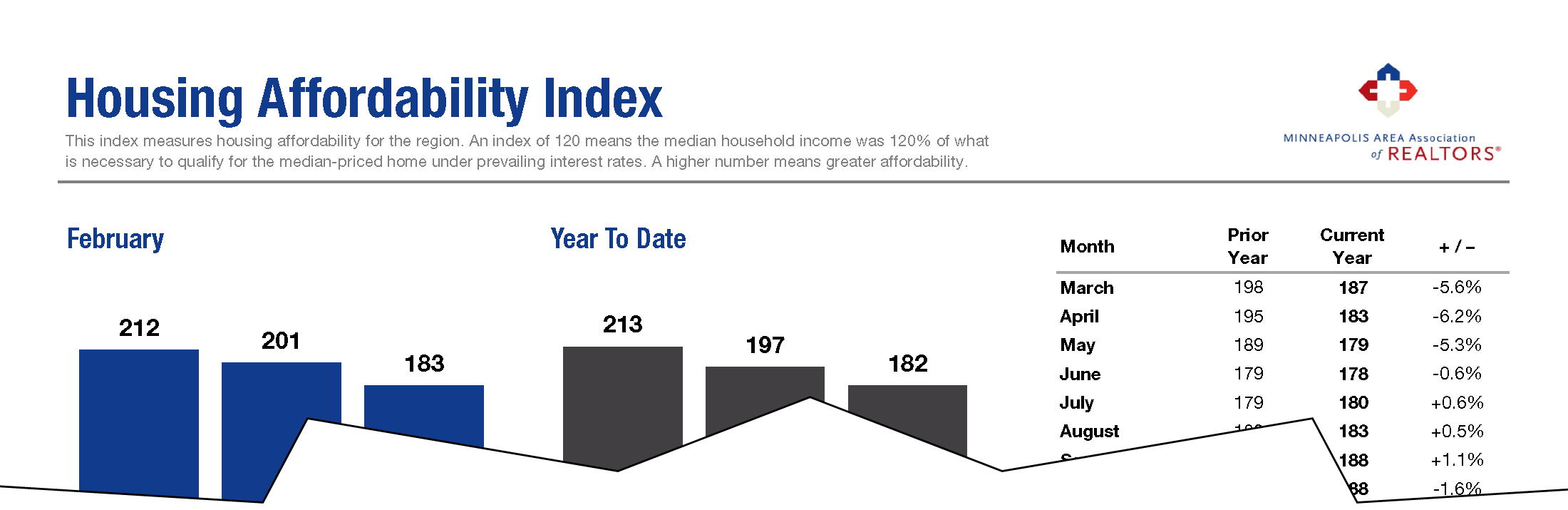

- Housing Affordability Index: When that gets down to the 2004 levels, I am out. Based on this chart, the 2005 – 2007 levels indicated that people were paying as much as they possibly could afford. They are not there yet.

- Months Supply of Inventory: We are currently under 2 months, based on the current market conditions, if I see that get above 4 and if key indicators 1 & 2 are moving in the wrong direction, it’s time to do something different.