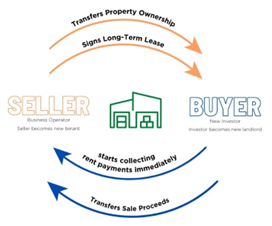

A sale-leaseback is a unique real estate transaction where a property owner sells their assets to a buyer and then leases it back from them. This arrangement allows the seller to continue using the property as a tenant while the buyer becomes the landlord. Sales leasebacks are particularly useful for businesses and individuals looking to access liquidity without sacrificing operational continuity.

Let’s explore the details, benefits, and drawbacks of sale-leasebacks.

How a Sale-Leaseback Works

- Sale: The property owner (seller) sells the property to a new owner (buyer) for cash.

- Leaseback: The seller becomes a tenant, leasing the property back from the buyer, who now owns it.

Benefits of a Sale-Leaseback

- Access to Capital

The seller can convert an illiquid asset (the property) into liquid capital immediately. This is particularly advantageous for:

- Paying off debt.

- Investing in growth initiatives.

- Funding operational expenses or acquiring new equipment.

- Continued Use of Property

The seller doesn’t have to move out after the sale. By leasing the property, they retain access without ownership, ensuring business continuity or uninterrupted personal use.

- Tax Advantages

For the seller, sale-leasebacks may offer tax benefits, such as:

- Deductible rental payments.

- Avoidance of debt obligations.

- Maximizing Property Value

In a robust real estate market, sellers can unlock the full value of their equity, often realizing gains beyond their initial investment.

- Flexibility

Unlike traditional loans, a sale-leaseback provides cash without increasing debt on the balance sheet, allowing for better financial flexibility.

Parties Involved in a Sale-Leaseback

- Seller-Tenant: The original property owner who now becomes the tenant.

- Buyer-Landlord: The new property owner who leases the property to the seller.

Disadvantages of a Sale-Leaseback

- Loss of Ownership

The seller relinquishes ownership and the associated benefits, such as appreciation over time or control of the asset.

- Potential Tax Liabilities

The sale may result in significant taxes, including capital gains taxes on the transaction.

- Higher Long-Term Costs

While rental payments may be fully deductible, they can accumulate to exceed the original ownership costs over time, particularly if rents increase.

- No Equity Building

As a tenant, the seller no longer builds equity in the property, which could limit future financial opportunities tied to ownership.

Who Uses Sale-Leasebacks?

Sale-leasebacks are commonly used by:

- Builders: To free up capital for new projects.

- Companies with High-Cost Fixed Assets: To reduce financial strain and reinvest in growth.

- Homeowners: To unlock home equity without taking on additional debt.

Purpose of Sale-Leaseback

The primary purpose is liquidity. For individuals or businesses, a sale-leaseback provides an immediate cash influx that can be used to meet both short- and long-term financial goals without the need for additional borrowing.

Advantages to the Seller

- Converts equity into liquid cash without needing to move.

- Avoids taking on new debt or loan obligations.

- Potentially more favorable than a loan, as every penny of equity can be accessed.

Disadvantages for the Seller-Tenant

- Loss of ownership means forfeiting future appreciation and equity building.

- Higher tax liabilities from the sale.

- Risk of rental costs exceeding previous loan payments over time.

Conclusion

A sale-leaseback can be a powerful tool for property owners who need immediate access to cash while continuing to use their property. It’s a strategic choice for those looking to avoid debt, maximize equity, and invest in growth. However, it’s crucial to weigh the benefits against the potential drawbacks, such as losing ownership and the long-term costs of renting. For the right situations, a sale-leaseback offers a win-win opportunity for both sellers and buyers.